Contents

Where the action results in a new entity with listed shares, and IBA decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. IBA CFDs are OTC contracts which deliver the return of the underlying stock, including dividends and corporate actions . Initially all cash used to fund the account is available for CFD trading. Any initial margin requirements for other instruments and cash used to purchase cash stock reduce the available cash. If your cash stock purchases have created a margin loan, no funds are available for CFD trades even if your account has significant equity. We cannot increase a margin loan to fund CFD margin under the ESMA rules.

- If you are a client of other IBKR entities, there is no separate segment.

- Every client order is first hedged on exchange and the LME OTC order filled at the price of the hedge.

- Open a Zero Markets trading account today and join over a million others globally trading 2,000+ markets on an easy-to-use platform.

- By partnering with Western Union , Dukascopy Bank enriches its offer of money transfer possibilities.

- He is a certified FMVA® and has an Honours Degree in Economics from the University of South Africa.

Open a Zero Markets trading account today and join over a million others globally trading 2,000+ markets on an easy-to-use platform. Go long or short with competitive spreads on indices, shares, forex, gold, commodities, cryptocurrencies, bonds and more. Plus, get extended hours on major US shares, AI-powered tools and 24/5 client support. The price of the CFD is the exchange-quoted price of the underlying share.

Say you’ve researched a stock but believe that it’s in for some tough times. Instead of searching for a new opportunity, you could short the company profitix news with a CFD, earning a profit if its share price falls. To open a short CFD position, you sell your chosen number of contracts instead of buying them.

The upside of this is it could potentially increase your profits while the downside it could on also amplify your losses. The Bank reminds its clients that if they require a wider scope of cryptocurrencies they can explore the recently launched P2P crypto exchange service. Dukascopy Bank’s marketplace for P2P exchange can process any blockchain. Therefore, it provides a secure environment to transact in virtually any token given that there is a counterparty willing to take the opposite side of the trade. Dukascopy Bank SA becomes the first Swiss bank that offers a hosted solution for money withdrawals via the Western Union network.

CFD trading ABC

Further assume that the closing price of ABC is $100 on Day 1, $110 on Day 2, $95 on Day 3 and $105 on Day 4. Open Trade Equity and Variation Margin are two methods by which brokers report CFDs to clients. While account equity and position P/L are identical under the two methods, they are represented differently for statement reporting purposes. An overview of each method is provided below for a sample position. A concentration charge is applied if your portfolio consists of a small number of CFD positions, or if the two largest positions have a dominant weight.

Shares, on the other hand, require you to purchase the stock and take ownership of the asset. Tether is joining Ethereum as a cryptocurrency that can be deposited/withdrawn by the MCA clients directly from/to their crypto wallets. This is also the first stable coin that the Bank is offering to its clients. Please beware of trading breaks for CFD’s and Bullion on US Memorial day, Monday 30th May.

Tight Forex

However, if you’re used to traditional trading and investing, you might find CFDs a bit more familiar than other derivatives. That’s because with CFD trading, you’re buying and selling contracts designed to mirror the assets they represent. With access to a huge range of markets, leverage and flexible short trades, it isn’t hard to understand why CFDs have become popular in recent years.

However, all cash in the F-segment can be used to cover losses arising from CFD trading. To determine the notional value of a tick, multiple the tick increment by the contract trade unit or multiplier. Accordingly, every tick change up or down results in a profit or loss of $1.00 per LIFFE Mini Silver futures contract.

If airline stocks start to climb again, you can close your CFD position. This works because you’re only speculating on the price movements of markets, not buying them outright. Again, your total profit would be £50 minus any commissions or broker fees.

SWFX – Swiss FX & CFD Marketplace

However for short positions a positive rate means a charge, a negative rate a credit. The following article is intended to provide a general introduction to forex-based Contracts for Differences issued by IB Australia . The margin requirements for the IBKR LME OTC Futures equal the requirement for the underlying contract on lime fx the LME. LME uses Standard Portfolio Analysis of Risk to calculate Initial Margin. In the OTE model, the accumulated P&L is carried as OTE, which is the difference between the closing price of the day and the price at which you opened the position. Equity therefore is Cash + OTE, and consistent with the VM model above.

By partnering with Western Union , Dukascopy Bank enriches its offer of money transfer possibilities. In effect, the clients of the Bank will obtain the opportunity to make cash withdrawals via the Western Union network across the world in 30+ currencies. Multibankfx.com needs to review the security of your connection before proceeding. The margins are the same as for the related future, adjusted for size, including lower rates intraday.

Then, when you want to close your trade, you buy the same number of CFDs. Swiss Bankers is an internationally oriented card and payments services provider based in Bern and Zurich. The company is cooperating with more than 200 banks and distribution partners from Switzerland and Lichtenstein.

IB Index CFDs are contracts which deliver the return of a market index. Said differently, the CFD is an agreement between the buyer and IB to exchange the difference between the current value of an index, and its value at a future time. IBA CFD quotes are identical to the Smart routed quotes for the underlying share.

“Close positions first”1.This is the default handling mode for all orders which close a position . In contrast, if you’re a typical retail shares investor, shorting the markets can be a complicated mt4 trailing stop ea process requiring borrowing then reselling stocks. This complexity is why investors tend to concentrate on buying with the anticipation that an investment’s price will rise over time.

EU markets watchdog clamps down on CFDs, ‘binary’ options

Unrealized profits however cannot be used to meet initial margin requirements. 63.7% of retail investor accounts lose money when trading CFDs with IBKR. IBKR does not offer any bonus or other incentives to trade CFDs. IBKR may in certain circumstances agree to reclassify a Retail Client as a Professional Client, or a Professional Client as a Retail Client. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Needs to review the security of your connection before proceeding.

Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn. D) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade.

The following article is intended to provide a general introduction to forex-based Contracts for Differences issued by IBKR. The following article is intended to provide a general introduction to share-based Contracts for Differences issued by IBA. You buy if you think the price will rise or sell if you believe it will fall. Whether you’re bullish or bearish, the process involved is the same. You make your market direction prediction and place the trade through your platform.

You will be provided with two options, Close Currency Balance which will close the single currency you’ve selected and Close All Non-base Currency Balances which will close all. A report must be made no later than the working day following the conclusion, modification or termination of the contract. • EUR 3 billion in gross notional value for OTC commodity derivative contracts and other OTC derivative contracts not covered above.

Contents

It could inspect the accounting books of the recognized stock exchanges in the country. It could also call for periodical returns from such stock exchanges. SEBI got the power of regulating and approving the by-laws of stock exchanges.

- The Securities and Exchange Board of India was established as a statutory body in the year 1992 and the provisions of the Securities and Exchange Board of India Act, came into force on January 30, 1992.

- The Securities and Exchange Board is the indicated regulative body for finance and markets in India.

- To file a company as an IPO, SEBI ICDR has laid down certain guidelines that are discussed below.

- SEBI has its headquarters at the business district of Bandra Kurla Complex in Mumbai and has Northern, Eastern, Southern and Western Regional Offices in New Delhi, Kolkata, Chennai, and Ahmedabad respectively.

He said, “The regulatory institution is under duress and under severe attack from powerful corporate interests operating concertedly to undermine SEBI”. He specifically said that Finance Minister’s office, and especially his advisor Omita Paul, were trying to influence many cases before SEBI, including those relating to Sahara Group, Reliance, Bank of Rajasthan and MCX. After the amendment of 1999, collective investment schemes were brought under SEBI except nidhis, chit funds and cooperatives. The Financial Industry Regulatory Authority is a nongovernmental organization that writes and enforces rules for brokers and broker-dealers. The Dodd-Frank Wall Street Reform and Consumer Protection Act is a series of federal regulations passed to prevent future financial crises. Critics say SEBI lacks transparency and is insulated from direct public accountability.

An aggrieved person can appeal to the Supreme Court under Regulation 15Z only a law question arising out of any decision of Securities Appellate Tribunal. On the website of SEBI, there is an online form available for investors to register complaints. If the complaint is regarding AMC, it is advised to initially consider registering the complaint on AMC’s website. https://1investing.in/ Investors can also send complaints to the address of the headquarters of SEBI. The classification of debt funds is prescribed on the basis of the duration of funds and a mix of asset quality. Except for index funds, the AMCs are allowed to have only one fund per classification, i.e., an AMC can have a maximum of 34 funds including funds in all the categories.

Functions

Thereby strengthening the infrastructure of Indian securities market, alongside its management. All the brokers, financiers, finance companies, and all sorts of mediators have to be registered with SEBI to participate in the stock market. It was established on 12th April 1988, with its headquarters in Mumbai. SEBI is the stock market regulator that oversees everything in the Indian stock market.

SEBI has also made a few policies and laid down guidelines for mutual funds in order to safeguard the interests of the investors. When it comes to stock exchanges, SEBI has the power to regulate and approve any laws related to functions in the stock exchanges. These functions are basically performed to keep a check on the functioning of the business in the financial markets.

As a result, the Government started the establishment of the Securities and Exchange Board of India. The above was the reason why the government established the body to look after the financial market in hope that the people will not lose their confidence in the market. Now, that we have seen the formation of the Securities and Exchange Board of India. Before the formation of SEBI, the Indian capital market was governed by the regulatory authority of the Controller of Capital Issues.

The Full Form of SEBI – Securities and Exchange Board of India

It also regulates and audits the performance of stockbrokers, sub-brokers, registrars, trustees of trust deeds, bankers to an issue, portfolio manager, and other intermediaries. This power incorporated upon the idea of a transparent and fair trade. It lies upon the belief that any unfair trade practices should be accounted for.

SEBI became empowered to inspect the books and records of financial Intermediaries. In this article, we take a closer look at what the SEBI is and its functions and powers. In September 2020, SEBI implemented new rules on margin pledge. The rule is expected to bring transparency and prevent misuse of clients’ securities by brokerage firms. The new margin rules were directed to come into effect from June 1, but were delayed due to pandemic pushing the implementation date to September 1.

Before investing in mutual fund investment, it is important for an investor to acquire accurate knowledge of the benefit of the mutual fund and its schemes. This helps in picking up the best schemes, grasping the guidelines and follow. The guidelines will also keep investors notified of the investors’ rights. The Introduction of the Securities and Exchange Board of India represents the essential functions of SEBI is the security of investors interests in protection. A platform to promote, improve and monitor the securities market in India. These companies are, usually, benefited from the expert-advice of the underwriters.

The Full Form of SEBI Meaning, and Definition

Controller of Capital Issues was the regulatory authority before SEBI came into existence; it derived authority from the Capital Issues Act, 1947. Pay 20% upfront margin of the transaction value to trade in cash market segment. Full form of SEBI is Securities and Exchange Board of India and the existence of SEBI means that any unwanted market activities won’t be allowed to occur so easily. SEBI has wide-ranging regulatory, investigative, and enforcement powers, including the ability to impose fines on violators. SEBI has the power to punish culprits by barring them from the market, imposing fines or both .

If, after investigation, SEBI finds any culprits, SEBI can punish them by barring them from the market, imposing fines, or both. The first and most important function of SEBI is to protect the investor from all sorts of frauds. This iframe contains the logic required to handle AJAX powered Gravity Forms. The lead manager must satisfy themselves about the net worth of the underwriters and the outstanding commitment and disclose the same to SEBI. A statement to this effect should be incorporated in the prospectus. If the issue is not underwritten and if the minimum subscription of 90% of the offer to the public is not received, the entire amount received as subscription would have to be returned in full.

From the trader’s perspective, they should be prepared for paying up margins upfront for any position in the market. For the brokers, this will surely reduce the risk of open positions as they would be covered by margins for peak risk. Coming to investor protection, SEBI has the power to draft legal rules to ensure the protection of the general public. As per sectoral classification prescribed by AMFI, the mutual fund scheme cannot take exposure in fixed income securities of more than 25% to a single sector.

Attach a time dimension to the investment schemes

But the increasing fraud and malfunctioning in the stock market in the later years arouse the need to establish a firm that would listen to the grievances of traders and investors. The Securities and Exchange Commission is a U.S. government agency created by Congress to regulate the securities markets and protect investors. Sebi has set out various guidelines for portfolio managers, foreign portfolio investors, buy-back schemes, IPOs, Mutual Funds, and many more. However, most of the guidelines are of the companies getting listed and financial institutions. Visit our websiteWealthBucketis the service provider of all types of mutual funds and their schemes.

Objective of SEBI

The Securities and Exchange Board of India is entitled to the following three powers. To stop such incidents of price rigging SEBI plays an effective role. One of the approaches of SEBI to prevent it is the introduction of circuits. Currently, the new broker Orril Trade, registered under SEBI to offer the broker services to its customer. It is a discount broker offering the provision to trade in different segments.

The only mechanisms to check its power are a Securities Appellate Tribunal, which consists of a panel of three judges, and the Supreme Court of India. The SEBI headquarters is located in the business district at the Bandra-Kurla Complex in Mumbai. It also has regional offices in the cities of New Delhi, meaning of sebi Kolkata, Chennai, and Ahmedabad, and more than a dozen local offices in cities including Bangalore, Jaipur, Guwahati, Patna, Kochi, and Chandigarh. Some criticize SEBI for that they say is a lack of transparency and direct accountability to the public for an institution with such enormous powers.

Contents

Oficjalnie Norwegię zamieszkuje blisko 100 tys. Polaków, którzy tym samym stanowią największą mniejszość w tym kraju. Sama Norwegia jest też bardzo atrakcyjna pod względem turystycznym, stąd również i wakacyjne zainteresowanie notowaniami NOK/PLN. To, ile kosztuje korona norweska ważne jest także dla importerów i esporterów. Kursy średnie NBP waluty szwajcarskiej w ostatnich 10 dniach.

Wyrażam zgodę na przetwarzanie moich danych osobowych w zakresie adresu mailowego na wysyłanie kodu rabatowego, zgodnie z ustawą o świadczeniu usług drogą elektroniczną. Korona norweska obecnie znajduje się pomiędzy koroną duńską (nominalnie najdroższa), a szwedzką (nominalnie najtańsza). 1 korona norweska dzieliła się na 100 ore, w 2012 roku norweskie „grosze” zostały jednak wycofane przez Norges Bank z obiegu. Wszystko przez wspominaną drożyznę i wysokie koszty produkcji monet.

Prosimy o upewnienie się czy rozumieją Państwo ryzyka związane z transakcjami na rynku forex lub zasięgnięcie porady niezależnego doradcy co do zaangażowania w tego typu transakcje. Forex.pl promuje usługi finansowe licencjonowanych podmiotów zarejestrowanych w Unii Europejskiej. Nie prowadzimy bezpośredniej sprzedaży produktów finansowych. Przedstawiamy ofertę wyłącznie dla nieokreślonego adresata. Sytuacja na rynku złota jest dynamiczna, ceny złota zmieniają się z sekundy na sekundę, w konsekwencji czego w Tavex ceny fizycznego złota są automatycznie aktualizowane co ok. 5 minut.

Kurs korony norweskiej – wykres

Nasze ceny są odzwierciedleniem najbardziej aktualnej sytuacji na rynkach walutowych. Oferujemy najlepsze kursy walut, a dodatkową korzyścią dla Klienta jest możliwośćnegocjacjiwarunków finansowych. Zapewniamy Państwu komfortowe warunki w naszych placówkach.

Kurs NOK korespondował natomiast z europejską jednostką rozliczeniową , która była bezpośrednim poprzednikiem euro. Norwegia zrezygnowała jednak z przystąpienia do strefy euro i zachowała NOK jako własną walutę. Interesują Cię aktualne kursy walut i cena korony norweskiej?

Kursy średnie NBP funta brytyjskiego w ostatnich 10 dniach. Kursy średnie NBP franka szwajcarskiego w ostatnich 10 dniach. Kursy walut online to Wiarygodność handlu z XM.COM Broker, przegląd warunków handlowych doskonały sposób na rozpatrzenie różnych scenariuszy, a także historii poszczególnych jednostek, przed podjęciem dowolnej decyzji inwestycyjnej.

Cennik Norwegia

Tak duże wahania kursu są rzadkie i podana przez Ciebie wartość nie zostałaby osiągnięta przez kilka miesięcy, a nawet lat. Korona norweska oznaczana jest na światowych rynkach kodem NOK. Choć obowiązuje tylko w słabo zaludnionej Norwegii, dane Banku Rozrachunków Międzynarodowych wskazują, że norweska korona odpowiada za aż 1,7 proc. Powyższe zalecenia dotyczą głównie nowych złotych monet i sztabek. Wiele historycznych złotych monet pozostawało w obiegu, a zatem są porysowane. Pomimo tego złoto zachowuje swoją wartość rynkową.

Funta, dolara i korony szwedzkiej na dzień 11 sierpnia 2022r. Walutomat to miejsce, w którym wymiana walut online nabiera nowego znaczenia. Dzięki społecznościowej platformie wymiany walut kupujesz waluty bezpośrednio od innych Klientów Walutomatu. Łatwa i szybka wymiana, najlepsze dostępne kursy wymiany, możliwość ustalenia własnego kursu sprzedaży lub kupna – tym właśnie Walutomat różni się od klasycznych kantorów stacjonarnych.

Z uwagi na duże koszty, jakie rodzi zakup jedzenia czy wynajmu mieszkania w Norwegii, to, ile kosztuje korona norweska, ma bowiem niemały wpływ na portfele turystów. Na szczęście, wzrost popularności pary NOK PLN, sprawił, że można ją wymienić łatwiej i taniej niż jeszcze kilka lat temu. Aktualne kursy walut w czasie rzeczywistym pochodzą z rynku walutowego Forex. Cena Bid to kurs po jakim dana waluta jest kupowana na rynku. Cena Ask to cena, po której waluta jest sprzedawana na rynku. Waluty, skup sprzedaż, kantor wymiany walut, Tczew, Malbork, Gniew, Starogard Gdański .

Dużo w relacji do tego, ile wynosiła przez ostatnich kilka lat (przez długi czas 1,5%, potem nawet 0,1%), ale niedużo w relacji do inflacji (17,9%). I to jest właśnie dylemat, przed którym stoi Rada. Wpisałeś kurs, który bardzo odbiega od aktualnego.

Paczkę odbieramy od Klienta w Polsce i dostarczamy bezpośrednio pod wskazany adres za granicą we wcześniej uzgodnionym terminie. Transakcje możesz opłacać wygodnymi metodami płatności. Zapisuje unikalny numer ID na Twoim urządzeniu mobilnym, by umożliwić określenie pozycji geograficznej na podstawie GPS. Używany do przesyłania danych do Google Analytics dotyczących rodzaju urządzenia i zachowania użytkownika. Dzięki temu możemy Cię rozpoznać, nawet jeśli korzystasz z różnych urządzeń. Używany przez usługę Piwik Analytics Platform do śledzenia zapytań stron użytkownika podczas sesji.

Zyskaj czas dzięki szybkiej realizacji transakcji wymiany walut. Nasz kantor może pochwalić się najszerszym wyborem walut we Wrocławiu. Zachęcamy do sprawdzania aktualnych kursów waluti negocjowania najkorzystniejszych cen.

Inne pary walutowe

Korzystaj z alertów walutowych, bądź na bieżąco z notowaniami i wymieniaj walutę po interesującym Cię kursie. Oferujemy rzetelną, szybką i profesjonalną obsługę. Gwarantujemy usługi na najwyższym poziomie, najbardziej konkurencyjne ceny oraz bezpieczne transakcje. W każdej naszej placówce posiadamy wydzielonepokoje kasowe, gdzie realizowane są duże operacje pieniężne. Mogą Państwo skorzystać z bezpłatnego konwoju przy wymianie większych kwot.

- Dla wygody korzystania wprowadziliśmy również cenniki dla odpowiednich kategorii.

- Przedstawiamy ofertę wyłącznie dla nieokreślonego adresata.

- Kurs NOK korespondował natomiast z europejską jednostką rozliczeniową , która była bezpośrednim poprzednikiem euro.

- Powyższe zalecenia dotyczą głównie nowych złotych monet i sztabek.

Platforma wymiany walut Walutomatu to gwarancja, że kupujesz bezpośrednio od innych sprzedających, bez drogiego pośrednictwa banków i kantorów. Dlatego wymiana z Walutomatem zawsze się opłaca. Historia korony norweskiej ściśle związana jest z wpływami sąsiednich państw skandynawskich. Początki waluty sięgają roku 1875, kiedy Norwegia, Dania i Szwecja, po zawiązaniu Skandynawskiej Unii Monetarnej, zdecydowały się wprowadzić do obiegu wspólną walutę – koronę.

Dla wygody korzystania wprowadziliśmy również cenniki dla odpowiednich kategorii. Wykres złota możesz teraz porównać z zakładką Cennik Złota 2022. Aktualne notowania cen srebra zestawisz z zakładką Cennik Srebra 2022.

Kurs dolara 19 października poniżej 4,9 zł

Oprócz wykresów zostały zaprezentowane tabele notowania w czasie rzeczywistym, na zielono podświetlające wzrosty, a na czerwono spadki. W ostatnich dekadach sytuacja na rynku walutowym zmieniała się pod wpływem przede wszystkim globalnych kryzysów. Wraz z początkiem pandemii nowego koronawirusa także można było zaobserwować zmiany w kursach walut. Gdy sytuacja zaczęła się stabilizować, a osłabione pandemicznym kryzysem gospodarki odrabiać straty, wybuchła wojna między Rosją i Ukrainą. W jaki sposób inwazja Rosji wpłynęła na kursy światowych walut?

Twoje dane osobowe nie będą przekazywane poza granice EOG ani udostępniane organizacjom międzynarodowym. Szyperska 14, operator serwisu InternetowyKantor.pl. Kurs korony norweskiej na wykresie jest prezentowany dla celów orientacyjnych, w oparciu o przybliżone dane i nie ma charakteru transakcyjnego tzn. Nie stanowi ze strony serwisu elementu oferty ani propozycji zawarcia transakcji. Śledź kurs korony norweskiej na wykresie i obserwuj trendy.

Przeglądaj najnowsze wiadomości z rynku, najciekawsze artykuły i najważniejsze ogłoszenia. Umożliwia zbieranie statystycznych danych na temat tego, jak korzystasz z naszej strony. Zapamiętuje ostatnio wybraną walutę w usłudze ofert społecznościowych (Druga waluta dla sprzedaży). Zapamiętuje ostatnio wybraną walutę w usłudze ofert społecznościowych (Pierwsza waluta dla sprzedaży). Jesteśmy firmą z ponad 20-letnim doświadczeniem. Oferujemy korzystne warunki kupna oraz sprzedaży walut.

Dla Polaków, którzy emigrują do Norwegii w celach zarobkowych. Korona norweska (norw. Krone) jest oficjalną walutą występującą w Norwegii. Korona jako taka obowiązuje w tym kraju od czasów Skandynawskiej Unii Monetarnej ze Szwecją i Danią.

Naszą ofertę kierujemy do osób indywidualnych i szeroko rozumianych podmiotów gospodarczych. W każdej naszej placówce posiadamy wydzielone pokoje kasowe, gdzie realizowane FOREXYARD Forex Broker Recenzja Forex są duże operacje pieniężne. Prosimy o powoływanie się na ceny zamieszczona na naszej stronie internetowej, gry będą Państwo przy kasie w siedzibie kantoru.

Zmienność rynku sprawia, że każdy inwestor powinien być na bieżąco z tym, jaka jest aktualna rynkowa cena złota lub cena srebra. Narzędzie udostępniane przez Tavex na tej podstronie umożliwia pogląd na kurs złota TP otrzymuje podejście do podejścia z grupy Science oraz kurs srebra w czasie rzeczywistym. Wykres cen złota SPOT i wykres cen srebra mogą być dowolnie personalizowane w zależności od Twoich preferencji. Dzięki temu możesz mieć szybki i bezpośredni podgląd np.

Poniżej przedstawiamy aktualne notowania korony norweskiej w naszym kantorze internetowym. Wpływ na to ma relacja pomiędzy podażą oraz popytem. Biznes w INTERII to najświeższe informacje gospodarcze – aktualne kursy walut, notowania giełdowe i cen surowców, wiadomości ze spółek głównego parkietu i NewConnect. Przeczytaj rekomendacje ekspertów i z sukcesem pomnażaj swój kapitał. Inwestycje na rynku forex z wykorzystaniem dźwigni finansowej obarczone są dużym ryzykiem poniesienia straty, łącznie z możliwością utraty wszystkich zainwestowanych funduszy.

In its quarterly report on Saturday, Berkshire said it adopted the equity method of accounting for its 20.9% stake in Occidental, which is worth more than $14 billion. Berkshire plans, starting in the fourth quarter, to report its share of the Houston-based company’s results with its own, with a one-quarter luno exchange review lag. Learn to speak, read, and write Thai and Thai script with our easy and fun online course. Nine years of experience teaching individuals and groups. On Bitbuy you can fund your account using Interac eTransfer, or Bank Wire. Each method of payment has its own fees and processing times.

Create an account and receive a unique referral code. For every person who signs up and makes a qualifying deposit with your referral code, you get $20 deposited in your account to buy Bitcoin and other cryptocurrencies. Once you’re signed up, you’ll need to fund your account before you can buy Bitcoin.

We’re implementing this rule to protect our customers. Once sent, cryptocurrency transactions can’t be reversed and you won’t get your money back if you’ve accidentally sent your funds to a scam or the wrong address. Evercode Lab is a non-custodial crypto wallet for BTC, BTC, ETH, DOGE, ADA, https://forex-review.net/ BNB, ERC-20 and +300 other coins. Numio is a layer 2 Ethereum wallet that lets users send, store, buy, and swap tokens and access decentralized applications . Luno is a cryptocurrency management platform that provides a digital wallet to securely handle different types of digital currency.

Coinomi

Bitcoin prices have been volatile, as have other cryptocurrencies. Prepare yourself to see prices go down and rise suddenly. You can take advantage of volatility to buy low and sell high. Hardware wallets store your private key on a device that can be kept offline or connected to the internet, such as a USB drive.

- Bitcoin may have found success as an investment product, but tech companies, travel sites, and e-commerce are helping Bitcoin realize its potential as a currency.

- Furthermore, companies like Luno and Paxful enable the population to trade Bitcoin.

- It’s designed to make trading CAD for Bitcoin intuitive and simple.

- The ones we are really impressed with will make it here to our product of the month feature.

- The area spanning $40,600 to $43,000 is a so-called polarity “zone of interest” where prior resistance has become future support and vice versa.

Instead you can use Bitcoin to buy these other cryptocurrencies. Ethereum has become a popular cryptocurrency to exchange for DeFi tokens, an emerging trend in crypto in 2021. One of the big reasons I love working at Luno is my fellow employees, or more commonly known as Lunauts. From day one, everyone was friendly and helpful, always willing to share their knowledge, local coffee spots or even taking time out of their day to have a chat in the kitchen to get to know me. A big indicator of a company’s culture is demonstrated by its leaders – at Luno it is very apparent that our culture trickles down from the founders and senior leadership team.

Luno videos and images

Humans have to sleep eventually, but a bot can keep trading 24/7. With cloud-based trading bots your computer won’t even need to be on for the bot to keep working. Find which cryptocurrency trading bots best suits your needs.

Bitbuy is an all in one platform, meaning you can trade cryptocurrencies for CAD, CAD for cryptocurrencies and crypto for crypto. They offer advanced trading through Bitbuy Pro, and over the counter services for high net worth individuals and businesses. In 2021, Canadians continue to buy and sell cryptocurrency in order to purchase items online, transfer value to a friend of a family member, and move money internationally. Investment is by far the most popular reason for owning Bitcoin.

Crypto arbitrage bots are trading software that scan through multiple exchanges to spot price discrepancies between the same crypto assets. Risk-free paper trading to backtest your trading bots and optimize your automated trading strategies. Arbitrage trading entails buying the same crypto asset from one exchange and selling it to another to profit from the difference in the asset value between the two exchanges. Finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation.

You can make a crypto arbitrage bot using python, a code editor or a Rule Builder. For instance, Trality is one of the top crypto arbitrage platforms that offer a python code editor and drag-n-drop rule builder to allow you to make your own bot. The top risk of arbitrage trading is market volatility. Asset prices may change before the trade is executed, resulting in significant losses.

It is actually a very secure wallet with less risk of fraud. Universal digital wallet that supports leading chains/cryptocurrencies. Staked is a cryptocurrency performance analysis solution that optimizes buying opportunities and calculates optimal asset allocation. I have some couple of wallet but only using binnce for my tranactions,i have luno,and coinbase as well. I recently started using coinomi and I can say it has a lot of listed coins than any other wallet I have on my phone. I think using the Luno, exodus and the atomic wallet can be a good option at start and those desktop wallets perform good too in the long run.

It stands for Know Your Customer and it’s used to prevent money laundering in a variety of industries, including real estate, securities, casinos, precious metals dealers, and now cryptocurrency. KYC verification is why you need to confirm your identity to a Canadian crypto exchange. After that, you just login and go whenever you want for fast Bitcoin transactions. A Canadian cryptocurrency exchange that lets you buy Bitcoin with Interac or eTransfer can save you money from high fees charged by international exchanges that won’t accept Canadian debit.

Some of the time having such wallet can be useful for the long term storage too. I use Luno, this wallet security is super strict and tight. You have to go through 2 steps verification steps, which i put my trust in it. Yeah and it has good interphase with different network you can send coins. Please ensure that all posts contribute positively to the discussion and are quality posts. Please read “What makes a worthwhile post? before posting. This section is not for questions or topics about Forum Coin and these discussions should instead be posted in our ForumCoin Related Discussions forum.

Luno Careers

When you first start making payments with Bitcoin, you may want to stick with major retailers as you familiarize yourself with the process. You will need to know the blockchain address of the retailer in order to send them payment. Are you buying Bitcoin as an investment or digital asset?

The new interface came alongside an expanded range of services and improved customer support. The guiding principle behind the new Bitbuy was to create a safe and secure Bitcoin platform that did not require extensive technical know-how. More and more retailers are accepting Bitcoin for purchases. Bitcoin may have found success as an investment product, but tech companies, travel sites, and e-commerce are helping Bitcoin realize its potential as a currency. You can buy goods and services online with Bitcoin, but make sure you know and trust the person or organization you send your Bitcoin. As the world’s first cryptocurrency gains acceptance with investors, retailers and everyday people, you don’t need another article explaining what Bitcoin is.

Sign up for exciting offers

The blockchain works in such a way that cryptocurrency transactions are not reversible. This means, that it’s not possible for Luno to recover any funds or reverse any transactions sent out of your Luno wallet. I met someone through social media I dont know him and introduced me to Luno. He took me through all the steps until I got reference code for every time, I make a deposit. I gave him a code and we agreed on a fee of 10% share every time I withdrew the money.

It’s made lessened the learning curve and given me the confidence to buy crypto. Secure crypto wallet and decentralized finance gateway that helps users store and transfer cryptocurrencies. BRD is a free mobile cryptocurrency wallet that allows users to buy, sell, and swap multiple types of digital currencies with rewards. Cryptocurrency wallet that allows users to manage various cryptocurrencies, such as Ethereum, Bitcoin, Litecoin, and more. Wallets and exchanges are diffrent, wallets are where users own private keys.

Contents

Learn all about stock trading and how you can get started. All MT4 features and then some, for the experienced trader. INFINOX holds brokerage licences across 3 global jurisdictions, so that you can trade safely with a fully licensed broker. Buy and sell CFD equities effortlessly when you trade with INFINOX. Although leverage can amplify gains with CFDs, leverage can also magnify losses.

The spread also decreases winning trades by a small amount compared to the underlying security and will increase losses by a small amount. So, while traditional markets expose the trader to fees, regulations, commissions, and higher capital requirements, CFDs trim traders’ profits through spread costs. Some retail traders on popular Reddit forums like WallStreetBets have used CFDs to place trades in meme stocks as well as cryptocurrencies like Dogecoin. These traders benefitted when certain online stockbrokers blocked clients from buying more GameStop shares and AMC shares because CFD trading continued mostly unabated.

In the UK, a bed and breakfast deal is when a trader sells a security at the end of the last day of the financial year and buys it back the next day. When the position is closed, the trader must pay another 0.01% commission fee of £10. A financing charge may apply if you take a long position; this is because overnight positions for a product are considered an investment . Traders are usually charged an interest charge on each of the days they hold the position. Some advantages of CFDs include access to the underlying asset at a lower cost than buying the asset outright, ease of execution, and the ability to go long or short. Ádám worked in banking and investment, and holds a professional degree in this field.

Traders Pay the Spread

As you can see, there is more to owning a share than merely participating in price appreciation. The right to a proportional share of dividends that are paid out. Get $25,000 of virtual funds and prove your skills in real market conditions. When it comes to the speed we execute your trades, no expense is spared. ThinkMarkets ensures high levels of client satisfaction with high client retention and conversion rates.

There are four key differences between investing in securities directly and purchasing a CFD. Above, you can compare the relevant CFD fees for the top 5 CFD brokers. Now that we’ve shown you the list of the best CFD brokers, let’s take a closer look at each one.

There are holding costs that are levied on traders at the end of a trading day. Whether these are positive or negative will depend on the direction of the trader’s position. For a full calculation of the profit or loss from a trade, you’d also subtract any charges or fees you paid. These could be overnight funding charges, commission or guaranteed stop fees. Instead, a position is closed by placing a trade in the opposite direction to the one that opened it. A buy position of 500 gold contracts, for instance, would be closed by selling 500 gold contracts.

Contracts for differences are contracts between investors andfinancial institutionsin which investors take a position on the future value of anasset. The difference between the open and closing trade prices arecash-settled. There is no physical delivery of goods or securities; a client and simple money reviews the broker exchange the difference in the initial price of the trade and its value when the trade is unwound or reversed. Most CFD trading platforms, however, give their clients access to several asset classes with one CFD trading account, usually forex pair like EUR/USD, GBP/ USD, etc.

A trader will inspect the market and make certain price speculations. Based on these speculations regarding the future price movement of the financial instruments, they will make a trade. The trader will buy a certain number of CFD units and will gain a point per movement in their favor. Similarly, they will also lose points if the price movement is against their speculations.

Chief Thomas has been with CFD since June 2022, serving as the Deputy Chief of Community Risk Reduction. He will assume command of the fire department effective October 21, 2022. While CFDs can be renewed with the agreement of both parties, that’s not the case with equity swaps.

What deposit methods does INFINOX offer?

You can base the floating leg on several things like a foreign equity denomination, or even on a fixed or floating rate of interest. biggest penny stock gainers You can carry forward or renew it at the end of a trading day. Structured Query Language What is Structured Query Language ?

Another downside of an equity swap is that it comes with an expiry date. The two parties pre-decide the closing date of the contract. Investors can renew CFDs indefinitely at the end of each trading day if they see any scope of making further profits. A Contract for Difference gives traders an opportunity to leverage their trading by only having to put up a small margin deposit to hold a trading position. It also gives them substantial flexibility and opportunity.

Should the buyer of a CFD see the asset’s price rise, they will offer their holding for sale. The net difference representing the gain or loss from the trades is settled through the investor’s brokerage account. Equity Swap and CFDs have a similarity in that the traders or investors who trade with them can benefit from the financial markets’ movement even without directly purchasing assets, or owning anything. To understand the CFD equity swap difference, we need to explore what an equity swap stands for.

Markets

Certain markets require minimum amounts of capital to day trade or place limits on the number of day trades that can be made within certain accounts. The CFD market is not bound by these restrictions, and all account holders can day trade if they wish. Accounts can often forex trading vs stock trading be opened for as little as $1,000, although $2,000 and $5,000 are common minimum deposit requirements. Many CFD brokers offer products in all the world’s major markets, allowing around-the-clock access. Investors can trade CFDs on a wide range of worldwide markets.

- For example, instead of buying or selling physical gold, a trader can simply speculate on whether the price of gold will go up or down.

- Once the stock has been borrowed, traders are restricted in the way they can execute a short trade.

- Pepperstone offer the popular MT4, MT5 and cTrader platforms.

Leverage adds extra risk because price moves in the market you are trading will represent a larger percentage of the margin you have deposited than if you paid the full amount. From the above classes of CFD brokers, you can decide which one suits your equity CFD exchange needs no matter your CFD trading experience level. Straight to the CFD exchange order book compared to transacting from a retail CFD brokers’ widened price. The best equity CFD brokers provide sound advice and an enabling CFD trading facility to help clients make worthy returns. FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET.

If not, be careful with the leverage ratio you choose (if you’re allowed to choose at all) and make sure you set the size of your trade position right. The great thing about CFD trading online is that you can do it anywhere there is a secure internet connection. Inevitably, this means that mobile trading has proven particularly popular as traders can conveniently open and close positions from their mobile or tablet as and when it suits them.

How much leverage a broker is allowed to offer a non-professional trader is limited in many jurisdictions, and also by many of the licensing authorities. Since most traders are not interested in the underlying rights but in exposure to changes to a stock price, CFDs are a low-cost way to take advantage of price changes. Traditional equity accounts do sometimes offer margin trading, yet this varies from broker to broker, is often limited to 50%, and often requires future collateral. CFD trading is generally available 24 hours per day, making it more accessible to international traders.

Originally, equity CFDs were used by a type of investment fund known as a hedge fund to protect its investments against losses. The use of equity CFDs quickly spread throughout the financial sector. Having a wide range of assets to invest in can be a great way to diversify your trades & avoid extreme losses. It’s never wise to put all your eggs in a single basket / invest all your money in a single market. Luckily, here at CAPEX, we offer CFDs on a wide range of instruments including stocks, indices, forex, ETFs, bonds, blends, commodities, and cryptocurrencies.

Is Trading CFDs Safe?

Alternatively, head to ourcountry selectorto find out which broker is available in your country. We have prepared a list of the top 5 online brokers that provide CFD trading. CFD trading, in a nutshell, is speculating whether a particular financial asset, like a stock index, commodity or a currency pair, will increase or decrease in value. Right after you’ve completed the sign-up process, we’ll verify your account, and you can begin your trading journey. You’ll then be guided to our trading platform, where we’ll ask you to complete your sign up process.

This has led some to suggest that CFD providers could exploit their clients. This topic appears regularly on trading forums, in particular when it comes to rules around executing stops, and liquidating positions in margin call. They argue that their offering reduces this particular risk in some way.

Instead, they trade on margin with units that are attached to a given security’s price depending on the market value of the security in question. The exception to this is our share CFDs, which are not charged via the spread. Instead, our buy and sell prices match the price of the underlying market and the charge for opening a share CFD position is commission-based. By using commission, the act of speculating on share prices with a CFD is closer to buying and selling shares in the market. If prices move against an open CFD position, additional variation margin is required to maintain the margin level. The CFD providers may call upon the party to deposit additional sums to cover this, in what is known as a margin call.

Since the CFD industry is not highly regulated, the broker’s credibility is based on its reputation and financial viability. They only need to open buying or selling positions on margins. This isn’t always the case though, with the main exception being a forward contract. A forward contract has an expiry date at some point in the future, and has all overnight funding charges already included in the spread. “Ireland looking to ban leveraged Forex and CFD trading for retail clients”.

Filter according to broker or product type, including stocks, futures, CFDs or crypto. Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. When trading CFD equities, a commission is charged to your account for executing your trades.

Contents

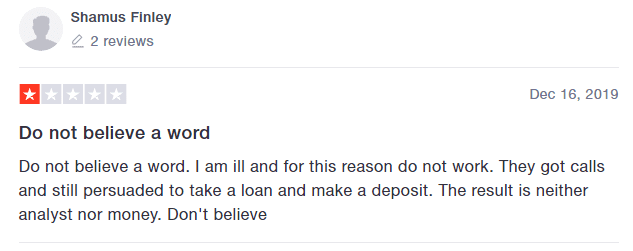

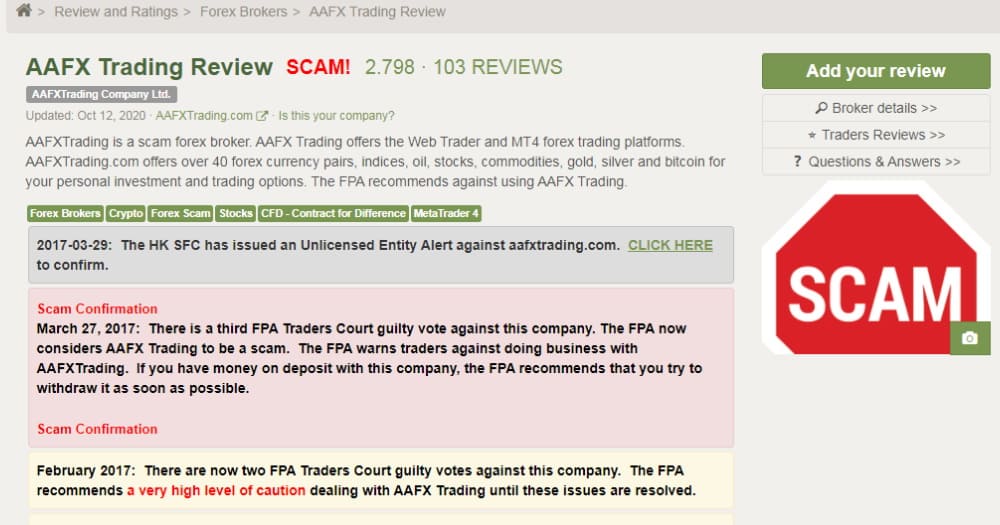

If you are thinking to invest with EndoTech broker, read the EndoTech review and get to know about the scam activities of broker in detail. If you are thinking to invest with Lak Sira Ltd broker, read the Lak Sira Ltd review and get to know about the scam activities of broker in detail. R24 Capital lacks any regulation and falsely claims to be licensed in the US. R24 Capital seems not to be regulated by any known regulating authority. If you want to invest with this broker, read the complete R24 Capital review and get to know the scam activities of the broker in detail.

Please complete this reCAPTCHA to demonstrate that it’s you making the requests and not a robot. If you are having trouble seeing or completing this challenge, this page may help. If you continue to experience issues, you can contact JSTOR support.

Tredexo review

Traders need to assess the news immediately after it is released and make a quick judgement on how to trade as a result. A contract for difference allows traders to speculate on the future market movements of an underlying item without owning it or taking physical delivery of it. CFDs can be used to trade a variety of underlying assets, including stocks, commodities, and foreign exchange. Bonds trading on LimeFX is a way of making profit from fluctuations in the value of corporate or government bonds.

- Traders who want to take control of their trading experience may prefer LimeFX.

- The minimum deposit on LexaTrade is $100, or it’s equivalent in the based currency of your choice.

- Some financial instruments LimeFX offer may be restricted in your country.

In essence, LimeFX margin trading is a facility under which one buys and sells stocks that they cannot afford. You are allowed to buy and sell stocks by paying a marginal amount of the actual value. We do not currently offer a trade copier service but it is very easy to follow the signals. Any problem with MT4 or the copier interface could result in multiple trades being opened that could cause devastating losses. We prefer to focus on quality signals and we manually enter them.

Each withdrawal method has its own withdrawal time which you will have to check before withdrawing your LimeFX account balance. LimeFX may have minimum withdrawal limits that you will need to check before withdrawing. While this may sound like an annoying fee, other brokers charge as much as $50/month as an inactivity fee, so LexaTrade’s cost remains on the low side. You can trade Forex CFD. Here, you can trade 24 hours a day, five hours a week. LexaTrade offers one of the most competitive pricing options among Forex brokers. It’s vital to keep in mind that users are giving their personally identifiable information when signing up for a trading site.

For Investors

This word refers to the difference between the best prices for buying and selling a certain asset at a particular moment. Moreover, in a transaction between a trader and a broker, the price is one, and between the broker and market users – another. This might be the most famous indicator of technical analysis.

You can decide for yourself whether LimeFX is right for you by looking at the standards. Traders can choose from thousands of stock CFDs in addition to shares.You can see the complete list of stocks here.LimeFX offers CFD stock trading. When trading CFD stocks you are not trading real stocks as you do not own any underlying stock assets.

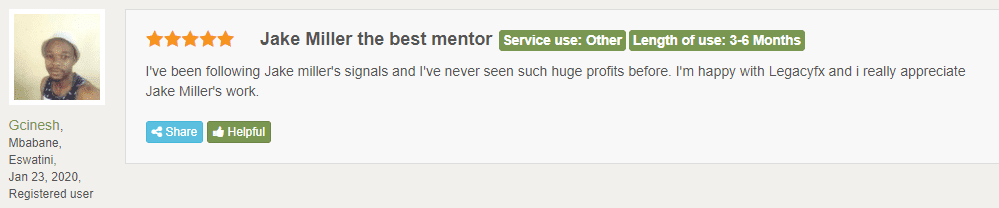

We know that many of our members can only follow the markets for part of the day and they still receive plenty of Forex trading signals. The experienced trader offers advice for novices and lexatrade reviews provides them with an opportunity to profit from market volatility with minimal risk. An develops effective and highly profitable strategies tailor-made for soft forex each individual beginner. Not long ago, she decided to share her knowledge through tutorials and webinars. Scammers usually have websites that are the complete opposite of user-friendly and they do not invest a lot in it. The trades performance includes a track record of seven years (2014 – 2021).

You may anticipate to receive your money within three business days for bank transfers, credit/debit cards, and digital wallets. LimeFX STP account is a LimeFX trading feature that involves sending LimeFX client orders directly to the market without passing them through a dealing desk. A LimeFX STP account is considered to be more of a hybrid of the ECN and market maker models.

More than a decade of experience trading in Forex

I had very good experience with this guys and I can recommend it to anyone. They go for trade with high probability not just for any trade. Discover accurate Forex signals, results verified independently and more… It provides us with upper hand to quickly adjust to the market’s conditions. Most business in the securities industry is conducted fairly, efficiently and in a manner that satisfies everyone involved. If you believe that a sales person, brokerage firm or other industry professional has treated you unfairly, contact the firm to see if you can resolve the issue.

- To help you with these and other LimeFX-related questions, FINRA provides the Securities Helpline for Seniors®.

- Any information communicated by 1000PipBuilder is solely for educational purposes.

- The trading strategies used for the signals took several years to develop.

- LimeFX telephone Support is often used for pre-sale queries, order taking, or even upselling and cross-selling, and troubleshooting.

- The aim of the market education is to ensure new traders become familiar with trading the leading capital markets.

- Investors can buy stock in fractional shares by specifying a dollar amount rather than the price of a whole share.

LimeFX mobile trading gives its users a platform to trade from anywhere in the world, as long as they have an internet or WiFi connection. The mobile trading app provides an ease of transacting while using a mobile device. This is because orders can be placed quickly and effortlessly.

Investors can buy fractional shares of a stock, making it easier to diversify even with modest amounts of money. Investors can buy stock in fractional shares by specifying a dollar amount rather than the price of a whole share. A LimeFX https://limefx.group/ stop order, also referred to as a stop-loss order, is an order to buy or sell a stock once the price of the stock reaches a specified price, known as the stop price. When the stop price is reached, a stop order becomes a market order.

Review company

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. LimeFX telephone Support is often used for pre-sale queries, order taking, or even upselling and cross-selling, and troubleshooting. Outbound calls are calls made to customers from the LimeFX call centre to give or take information. If you’re having a withdrawal transferred to your digital wallet account, your LimeFX should arrive in less than 24 hours.

- Depending on your geo region certain withdrawal methods may be more convenient to you.

- For a more robust trading experience, consider LimeFX, IG, and CMC Markets.

- A signals performance is essential to any forex signal provider covering the leading financial markets.

- When you join as a member, you will receive detailed information explaining how our Forex signals work and the key information you need to start trading Forex.

A private person can make transactions with all these instruments only on a trading platform, access to which is provided by a broker or a crypto exchange. One of the greatest obstacles in live forex trading signals is the entry price. In ddmarkets we tend to use longer time frames such as the daily, weekly or month charts, which makes the entry price less sensitive when compared to scalping or intraday trading. We also provide a price range in which the signal may still be executed, which adds to the experience of using our forex trading signals that are suitable for all investors and traders. Forex trading with LimeFX is a method through which to invest money which involves trading one currency for another in a Forex currency pair with LimeFX.

It is a free-of-charge Forex trading platform, offering wide technical analysis options, flexible trading system, and algorithmic and mobile trading. MT4 is a popular online trading platform that can be used to automate one’s trading. Its limefx review simple user interface provides users with access to advanced technical analysis and flexible trading systems. Regardless of how you trade, there is always a risk to online trading, as well as some key advantages to using such a method.

Lexatrade Regulation:

There is a substitution of data in order to make operations unprofitable. At the same time, the trader thinks that his operations were made on the market, but in fact – just on the site of scammers. Traders can follow the markets and make wise LimeFX decisions on LimeFX by using the news to help form a strategy when it comes to choosing LimeFXs. A LimeFX news trading strategy involves trading based on news and market expectations, both before and following news releases.